Understanding the Old vs. New Tax Regime in India for FY 2024-25

Paying taxes is an essential responsibility for citizens, and in India, this process has recently become more dynamic. The government has introduced a new tax regime alongside the old one, giving taxpayers the flexibility to choose between them.

Paying taxes is an essential responsibility for citizens, and in India, this process has recently become more dynamic. The government has introduced a new tax regime alongside the old one, giving taxpayers the flexibility to choose between them. However, making the right decision requires a thorough understanding of both systems. This blog breaks down the differences between the old and new tax regimes for FY 2024-25 in simple terms to help you make an informed choice.

What is an Income Tax Slab?

Income tax slabs are structured like a staircase, where each step represents a different tax rate. As your income increases, you move to higher steps, paying a higher percentage of tax on the incremental income. This progressive taxation system ensures fairness by charging higher rates to those who earn more.

Income Tax Slabs for Different Age Groups

In India, tax slabs are categorized based on age:

- Individuals under 60 years old

- Senior citizens (60 to 80 years old)

- Super senior citizens (above 80 years old)

These slabs are periodically updated during the Union Budget announcements to account for inflation and other economic factors.

Overview of the New Tax Regime

The new tax regime, introduced in 2020 and refined further in subsequent budgets, aims to simplify the taxation process. Here are the key features:

- Lower Tax Rates: Compared to the old tax regime, the new system offers reduced rates across various income brackets.

- Limited Deductions and Exemptions: While the rates are lower, you lose access to many common deductions and exemptions like HRA and 80C benefits.

- Default Option: Since the 2023-24 financial year, the new tax regime is the default system unless a taxpayer opts for the old regime.

Revised Tax Slabs for FY 2024-25

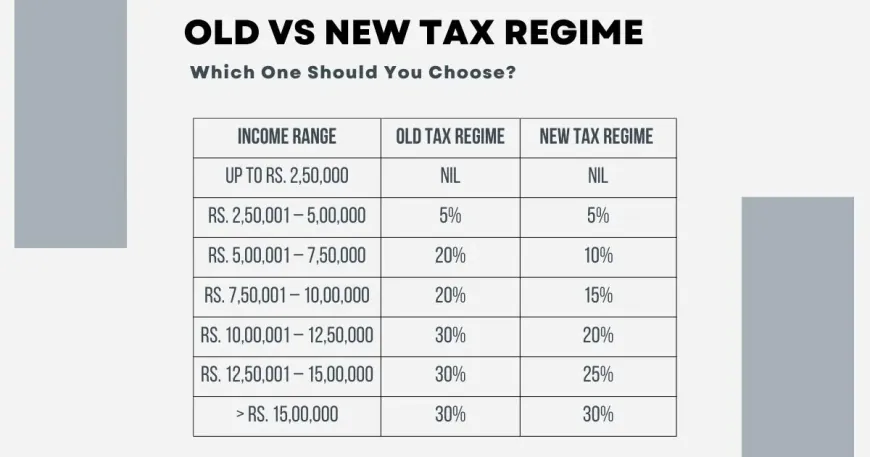

The 2024 Budget introduced some critical updates to the new tax regime, further distinguishing it from the old system. Below is a comparison of the tax slabs before and after the budget:

| Income Bracket | Tax Rate FY 2023-24 | Tax Rate FY 2024-25 |

|---|---|---|

| Up to ₹3 lakh | Nil | Nil |

| ₹3 lakh - ₹6 lakh | 5% | ₹3 lakh - ₹7 lakh: 5% |

| ₹6 lakh - ₹9 lakh | 10% | ₹7 lakh - ₹10 lakh: 10% |

| ₹9 lakh - ₹12 lakh | 15% | ₹10 lakh - ₹12 lakh: 15% |

| ₹12 lakh - ₹15 lakh | 20% | ₹12 lakh - ₹15 lakh: 20% |

| Above ₹15 lakh | 30% | 30% |

Additional Benefits in the New Tax Regime

- The standard deduction has been increased to ₹75,000.

- The family pension deduction is now ₹25,000.

- These changes collectively result in tax savings of up to ₹17,500 for taxpayers.

The Old Tax Regime

The old tax regime continues to be popular, particularly among taxpayers who can claim various deductions and exemptions. Key aspects include:

- Higher Tax Rates: The tax rates under the old regime are relatively higher compared to the new system.

- Extensive Deductions and Exemptions: Taxpayers can claim deductions under sections like 80C (up to ₹1.5 lakh), 80D for health insurance, HRA, LTA, and many others.

- Flexibility for Planners: It’s more suitable for individuals who actively plan their taxes and have investments or expenses that qualify for deductions.

Comparison: Old vs. New Tax Regime

| Criteria | Old Tax Regime | New Tax Regime |

|---|---|---|

| Tax Rates | Higher | Lower |

| Deductions/Exemptions | Available for various expenses and investments | Limited |

| Default Option | No | Yes |

| Complexity | Relatively more complex due to numerous rules | Simpler |

| Who Benefits Most? | Those with significant investments/deductions | Those with no or fewer deductions |

Factors to Consider While Choosing Between the Two

Choosing the right tax regime depends on several factors:

1. Income Level and Taxable Amount

- If your income falls within lower tax brackets, the new regime might be beneficial.

- For higher incomes with substantial deductions, the old regime may provide more savings.

2. Eligible Deductions

- Under the old regime, popular deductions include:

- Section 80C: Investments in PPF, ELSS, insurance premiums.

- Section 80D: Medical insurance premiums.

- HRA and LTA: Exemptions based on housing and travel allowances.

3. Tax Planning Style

- The old regime is suitable for those who actively invest and plan finances.

- The new regime caters to taxpayers who prefer simplicity and don’t want to invest primarily for tax savings.

Illustration: Tax Calculation

Let’s consider a hypothetical example of two taxpayers earning ₹10 lakh annually:

-

Taxpayer A (Old Regime):

- Deductions claimed: ₹1.5 lakh (80C), ₹25,000 (80D), ₹50,000 (standard deduction).

- Taxable income: ₹7.75 lakh.

- Total tax payable: ₹66,500 (after rebates).

-

Taxpayer B (New Regime):

- No deductions claimed.

- Taxable income: ₹10 lakh.

- Total tax payable: ₹60,000.

In this case, Taxpayer B pays less tax under the new regime due to lower rates, but Taxpayer A saves more by leveraging deductions.

Which Regime Should You Choose?

The decision boils down to your financial profile:

-

Opt for the New Tax Regime if:

- You have minimal deductions or exemptions.

- You prefer a straightforward tax calculation.

- You fall within a lower income bracket.

-

Stick with the Old Tax Regime if:

- You can maximize deductions and exemptions.

- You are comfortable with slightly complex tax planning.

- Your income allows significant savings through exemptions.

Understanding the differences between the old and new tax regimes is essential to optimize your tax outgo. While the new regime simplifies the process, the old system rewards taxpayers who invest wisely. Evaluate your financial situation, consider your eligible deductions, and calculate the tax payable under both systems to make an informed decision.

Remember, a little effort in tax planning can go a long way in securing your financial well-being!

Bajrang Sharma

Bajrang Sharma