The Rise of UPI and the Role of UPI Reference Numbers in Digital Payments

Digital payments in India have witnessed unprecedented growth in recent years. Much of this success is attributed to the Unified Payments Interface (UPI), a revolutionary instant payment system developed by the National Payments Corporation of India (NPCI).

Digital payments in India have witnessed unprecedented growth in recent years. Much of this success is attributed to the Unified Payments Interface (UPI), a revolutionary instant payment system developed by the National Payments Corporation of India (NPCI). This innovation has transformed the way people and businesses conduct financial transactions, offering a secure, fast, and convenient method for payments.

One of UPI's standout features is the UPI reference number, a simple yet powerful tool that ensures transparency and security in transactions. In this blog, we will explore the significance of UPI reference numbers, their benefits, and a guide to using them effectively.

What is a UPI Reference Number?

A UPI reference number is a 12-digit unique identifier generated for every UPI transaction. This number acts as a digital receipt for payments, providing a way to verify and track transactions. It is typically displayed below the transaction amount in your UPI app or digital passbook.

The UPI reference number serves as proof of payment and can be used to resolve disputes, check transaction status, or retrieve details of any completed transfer.

How to Find the UPI Reference Number?

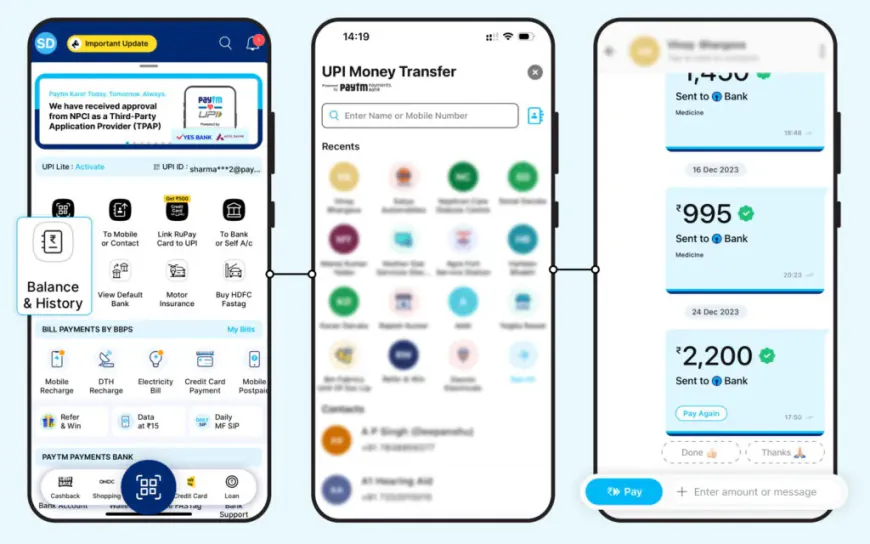

Finding your UPI reference number is a straightforward process. While the exact steps may vary depending on the payment app you use, the general procedure remains consistent. Below is a step-by-step guide to locate your UPI reference number.

Steps to Locate Your UPI Reference Number

- Open Your UPI App: Log in to the UPI app where the transaction was initiated.

- Go to Transaction History: Navigate to the 'Passbook' section in Paytm or the 'History' section in PhonePe or Google Pay.

- Select the Bank Account: Choose the bank account linked to your UPI app.

- Identify the Transaction: Scroll through the transaction list and click on the one you need details for.

- Find the UPI Reference Number: The 12-digit UPI reference number will be displayed on the transaction details page.

By following these steps, you can quickly access your UPI reference number to resolve any queries or discrepancies.

Benefits of UPI Reference Numbers

The UPI reference number is not just a unique identifier but a multi-functional tool that adds value to digital payments. Here are some key benefits:

1. Easy Transaction Tracking

The reference number enables users to track the status of their transactions in real-time. If there is any issue, such as a failed payment or a delayed credit, the reference number can help identify the root cause.

2. Enhanced Security and Privacy

UPI eliminates the need to share sensitive details like bank account numbers or card information during a transaction. By relying on the UPI reference number, users can maintain their privacy while resolving payment-related issues.

3. Simplified Dispute Resolution

In case of discrepancies, providing the UPI reference number to the bank or merchant allows them to quickly fetch transaction details, making the resolution process smoother and faster.

4. Accessibility

With the UPI reference number, users can retrieve payment details anytime, even months after the transaction. This is particularly useful for small businesses managing multiple payments.

The Importance of UPI in Small Enterprises

The advent of UPI has revolutionized financial transactions for small businesses. By simplifying payment processes, UPI has made it easier for small enterprises to:

- Accept payments from customers without investing in expensive POS systems.

- Manage cash flow efficiently with instant fund transfers.

- Enhance customer experience with quick, seamless transactions.

The UPI reference number tracking system has further streamlined these operations by offering a reliable method to monitor and verify transactions.

How Does a Reference ID Work in Banks?

In the banking ecosystem, a reference ID is a unique identifier for every online and offline transaction. This ID helps both customers and banks keep track of financial activities. Similarly, the UPI reference number functions as a bridge between two bank accounts, ensuring secure and traceable transactions.

For example, if a merchant does not receive payment due to a technical error, they can use the UPI reference number to verify the payment's status with their bank.

Smart Payment Trends and the Future of UPI

The rise of UPI aligns with the broader trend of smart payments, where technology simplifies financial transactions. UPI apps are continually upgrading their features, incorporating AI-driven tools for fraud detection, and integrating with e-commerce platforms for a seamless shopping experience.

The future of UPI looks promising, with potential advancements like:

- Cross-border UPI payments: Expanding the usability of UPI for international transactions.

- Voice-enabled payments: Making payments accessible for people who may not be tech-savvy.

- Advanced analytics: Providing insights to users and businesses to track spending habits and manage finances better.

Conclusion

The growth of UPI is a testament to India’s technological advancements in the financial sector. The UPI reference number is a cornerstone of this system, offering users a secure, transparent, and efficient way to track transactions. For small businesses and individual users alike, UPI has redefined convenience in payments.

As more people adopt digital payment methods, understanding tools like the UPI reference number becomes crucial. It not only enhances trust but also ensures seamless functionality in the ever-evolving digital payment landscape.

Key Takeaways

- UPI reference numbers provide a secure and traceable way to track digital payments.

- These numbers simplify dispute resolution and improve transaction transparency.

- Small enterprises benefit immensely from UPI's instant and secure payment ecosystem.

- The future of UPI promises exciting advancements, further boosting its adoption.

By leveraging the full potential of UPI and its features like the UPI reference number, individuals and businesses can embrace a cashless future with confidence.

Bajrang Sharma

Bajrang Sharma