How to Register a UPI Complaint Online: A Step-by-Step Guide

Unified Payments Interface (UPI) has become a game-changer in India’s digital payment ecosystem. It enables seamless, instant transactions between users, fostering a cashless economy. Despite its convenience, UPI users sometimes encounter issues like failed transactions or unauthorized deductions.

Unified Payments Interface (UPI) has become a game-changer in India’s digital payment ecosystem. It enables seamless, instant transactions between users, fostering a cashless economy. Despite its convenience, UPI users sometimes encounter issues like failed transactions or unauthorized deductions. Knowing how to lodge a complaint can ensure that such problems are addressed swiftly and effectively. This guide will walk you through the process of registering a UPI complaint online.

1: Why Filing a UPI Complaint Matters

UPI complaints are not just about resolving personal inconveniences—they also play a vital role in enhancing the overall functionality of the system. Here’s why filing a complaint is important:

2: Safeguard Your Money

Mistakes such as sending money to the wrong account or deductions during failed transactions can lead to financial loss. Filing a complaint helps recover your funds and ensures you aren’t left in a lurch.

Strengthen UPI Systems

Every complaint provides valuable insights to service providers about potential issues. This feedback helps them improve the UPI ecosystem and minimize future disruptions.

Prevent Fraud

Digital platforms are susceptible to fraud. Reporting suspicious activity ensures that fraudulent transactions are flagged early, protecting your account from further harm.

1: Common UPI Problems Requiring Complaints

UPI users may encounter several challenges during transactions. Below are the most frequent issues:

1. Failed Transactions

You attempt a transaction, and while the amount is debited from your account, the recipient doesn’t receive it.

2. Wrong Transfers

Money mistakenly sent to an incorrect UPI ID can create panic. Prompt complaint registration is key to retrieving such transfers.

3. Delayed Refunds

Refunds for cancelled or failed transactions often take longer than expected. Filing a complaint expedites the process.

4. Account Linking Errors

If you're unable to link your bank account with your UPI app, the issue may require troubleshooting by the bank or app provider.

5. UPI PIN Issues

Challenges in setting, resetting, or using your UPI PIN can disrupt your ability to transact.

6. Unauthorized Transactions

Unauthorized deductions or unknown transactions should immediately be reported to prevent further misuse of your account.

How to Register a UPI Complaint Online

Filing a UPI complaint is a straightforward process, usually facilitated through the app or platform you are using. Follow these steps:

Step 1: Identify the Problem

- Check your transaction history to understand the issue.

- Make a note of the transaction ID, UPI ID, and other relevant details.

Step 2: Approach Your UPI App

Most UPI complaints can be resolved directly within the app. Here’s how to proceed for popular UPI platforms:

Google Pay

- Open Google Pay and navigate to the "Help and Feedback" section.

- Select the transaction in question and tap "Raise Dispute".

- Fill in the required details and submit the complaint.

PhonePe

- In the PhonePe app, go to the "My Transactions" section.

- Choose the problematic transaction and click on "Report an Issue".

- Provide the necessary information and file the complaint.

Paytm

- Open Paytm and access the "24x7 Help" section.

- Find the transaction under "UPI" and choose the relevant issue.

- Submit the complaint with supporting details.

Step 3: Contact Your Bank

If the issue persists or isn’t resolved by the UPI app, contact your bank. Most banks have dedicated grievance portals where you can file a complaint online. You'll typically need the following details:

- Transaction reference number

- Your registered mobile number

- Date and amount of the transaction

Step 4: Escalate to NPCI

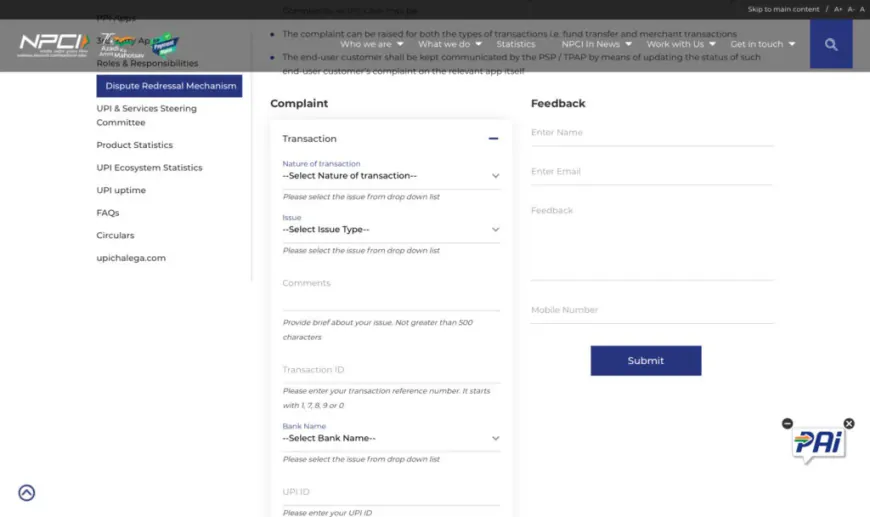

If neither the UPI app nor your bank resolves the issue within 30 days, escalate the matter to the National Payments Corporation of India (NPCI):

- Visit the NPCI’s official website.

- Navigate to the "Dispute Redressal" section.

- Fill out the complaint form and provide all required transaction details.

Step 5: RBI Ombudsman

As a last resort, if your issue remains unresolved, approach the RBI Ombudsman. You can file a complaint online via the RBI’s Complaint Management System.

Tips for a Smooth Complaint Resolution

Be Prompt

The sooner you report an issue, the faster it can be resolved. Immediate action also reduces the risk of further complications.

Gather All Relevant Details

Before filing a complaint, compile all necessary transaction details such as UPI ID, transaction reference number, and date. This ensures your complaint is processed without delays.

Maintain Follow-Ups

Keep track of your complaint status and follow up with the concerned parties until the issue is resolved.

Use Secure Channels

Always file complaints through official channels to protect your personal and financial information from potential fraudsters.

Unified Payments Interface (UPI) has undeniably transformed the way India transacts digitally. However, technical glitches, fraud, or user errors can occasionally disrupt this seamless experience. Knowing how to file a UPI complaint online equips you with the tools to address these challenges efficiently.

Whether it’s a failed transaction or an unauthorized deduction, take prompt action by raising a complaint through your UPI app, bank, or even the NPCI. By doing so, you not only safeguard your money but also contribute to making UPI a more reliable payment system for all.

Bajrang Sharma

Bajrang Sharma